The world of tax forms can be overwhelming, especially for those who are new to the tech industry. As a startup founder, entrepreneur, or freelancer, navigating the complex landscape of tax laws and regulations can be daunting. However, understanding first tech tax forms is crucial to ensuring compliance with tax authorities, avoiding penalties, and maximizing tax benefits. In this article, we will delve into the world of tech tax forms, exploring the different types, their purposes, and how to tackle them with confidence.

The Importance of Tax Compliance in the Tech Industry

The tech industry is rapidly evolving, with new innovations and business models emerging every day. However, this growth also brings new tax challenges. The IRS and other tax authorities are increasing their scrutiny of tech companies, and non-compliance can result in severe penalties, fines, and even reputational damage. Therefore, it is essential for tech companies to prioritize tax compliance and understand the various tax forms required to report their income, expenses, and other tax-related information.

Types of Tech Tax Forms

There are several types of tax forms that tech companies may need to file, depending on their business structure, size, and activities. Here are some of the most common tech tax forms:

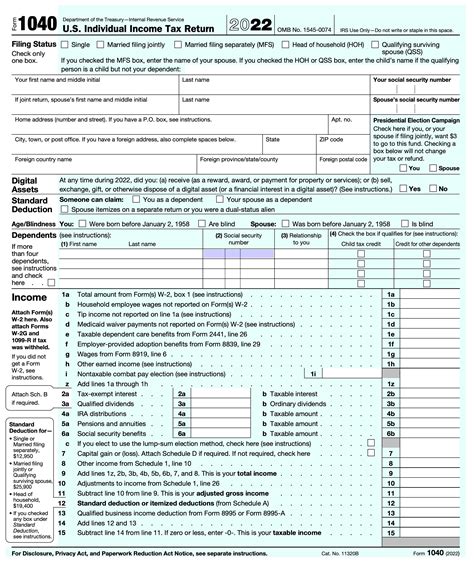

Form 1040: Personal Income Tax Return

Form 1040 is the standard form used by individuals to report their personal income tax. Tech entrepreneurs and freelancers may need to file Form 1040 to report their business income, expenses, and other tax-related information.

Form 1120: Corporate Income Tax Return

Form 1120 is the standard form used by corporations to report their income tax. Tech companies that are structured as corporations may need to file Form 1120 to report their business income, expenses, and other tax-related information.

Form 941: Employer's Quarterly Federal Tax Return

Form 941 is the standard form used by employers to report their quarterly federal tax return. Tech companies that have employees may need to file Form 941 to report their employment taxes, including Social Security and Medicare taxes.

How to Tackle Tech Tax Forms

Tackling tech tax forms can be a daunting task, but with the right approach, it can be manageable. Here are some tips to help you navigate the world of tech tax forms:

- Keep accurate records: Keeping accurate records of your business income, expenses, and other tax-related information is crucial to ensuring compliance with tax authorities.

- Consult with a tax professional: If you are unsure about how to complete a particular tax form or need guidance on tax compliance, consult with a tax professional who has experience in the tech industry.

- Use tax software: Tax software can help simplify the tax filing process and reduce errors. Look for software that is specifically designed for tech companies and offers features such as automated calculations and error checking.

- Stay up-to-date with tax laws and regulations: Tax laws and regulations are constantly changing, so it is essential to stay up-to-date with the latest developments. Follow reputable sources, such as the IRS and tax industry publications, to stay informed.

Gallery of Tech Tax Forms

FAQs

What is the deadline for filing Form 1040?

+The deadline for filing Form 1040 is typically April 15th of each year.

Do I need to file Form 941 if I am a sole proprietor?

+No, sole proprietors do not need to file Form 941. However, they may need to file Form 1040 and Schedule C to report their business income and expenses.

Can I file my tax forms electronically?

+Yes, you can file your tax forms electronically through the IRS website or through tax software. Electronic filing can help reduce errors and speed up the processing of your tax return.

In conclusion, understanding first tech tax forms is essential for tech companies to ensure compliance with tax authorities, avoid penalties, and maximize tax benefits. By keeping accurate records, consulting with a tax professional, using tax software, and staying up-to-date with tax laws and regulations, tech companies can navigate the complex world of tax forms with confidence.