In today's digital age, securing high-tech personal checks is more crucial than ever. With the rise of identity theft and check fraud, it's essential to take proactive measures to protect your financial information and prevent unauthorized access to your accounts. Here are five ways to secure high-tech personal checks:

Understanding the Risks of Check Fraud

Before we dive into the ways to secure high-tech personal checks, it's essential to understand the risks associated with check fraud. Check fraud can occur in various forms, including:

- Identity theft: Thieves steal your personal and financial information to create counterfeit checks.

- Check tampering: Thieves alter the payee's name, amount, or other details on a legitimate check.

- Check kiting: Thieves write checks from one account to another, taking advantage of the float time to withdraw funds.

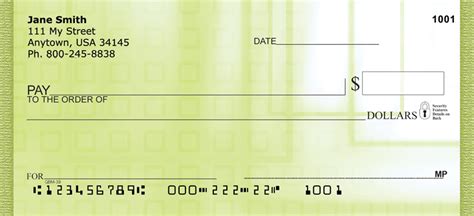

1. Use Secure Check Printing Features

High-tech personal checks often come with advanced security features that make it difficult for thieves to create counterfeit checks. Look for checks with the following features:

- Microprinting: Tiny text that's difficult to read with the naked eye.

- Watermarks: Translucent patterns woven into the paper.

- Security threads: Thin strips embedded in the paper that glow under UV light.

- Foils: Metallic strips that reflect light and make it hard to reproduce.

2. Implement Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your online banking and check ordering processes. This ensures that even if a thief obtains your login credentials, they won't be able to access your account or order checks without the second factor.

- SMS or email codes: Receive a unique code via SMS or email that you must enter to complete the transaction.

- Biometric authentication: Use facial recognition, fingerprint scanning, or voice recognition to verify your identity.

3. Monitor Your Accounts Regularly

Regularly monitoring your accounts is crucial to detecting and preventing check fraud. Set up alerts for:

- Large transactions: Receive notifications for transactions above a certain amount.

- Suspicious activity: Receive notifications for transactions that seem suspicious or out of the ordinary.

4. Use a Secure Check Ordering Process

When ordering checks online, make sure to use a secure process that protects your financial information. Look for:

- HTTPS encryption: Ensure the website uses HTTPS encryption to protect your data.

- Secure checkout: Use a secure checkout process that requires a password or 2FA.

5. Shred and Dispose of Checks Properly

Finally, make sure to shred and dispose of checks properly to prevent thieves from obtaining your financial information. Use a:

- Cross-cut shredder: Shred checks into small, unreadable pieces.

- Secure disposal bin: Dispose of shredded checks in a secure bin that's difficult to access.

Gallery of Secure Check Features

What is check fraud?

+Check fraud occurs when a thief creates or alters a check to steal money from an account or obtain goods and services.

How can I prevent check fraud?

+You can prevent check fraud by using secure check printing features, implementing two-factor authentication, monitoring your accounts regularly, using a secure check ordering process, and shredding and disposing of checks properly.

What is two-factor authentication?

+Two-factor authentication is a security process that requires a user to provide two different authentication factors to access an account or complete a transaction.

By following these five ways to secure high-tech personal checks, you can significantly reduce the risk of check fraud and protect your financial information. Remember to stay vigilant and monitor your accounts regularly to detect any suspicious activity.