The world of credit cards has undergone a significant transformation in recent years, with the integration of modern technology being a key driver of this change. Gone are the days of simple, static credit cards; today's cards are equipped with advanced features, enhanced security measures, and innovative designs that make them an essential tool for modern life.

The rise of contactless payments has been a major factor in the evolution of credit cards. With the tap of a card or a swipe of a smartphone, users can make transactions quickly and easily, without the need for cash or PINs. This technology has been made possible by the introduction of Near Field Communication (NFC) and Radio Frequency Identification (RFID) chips, which enable secure and seamless communication between the card and the payment terminal.

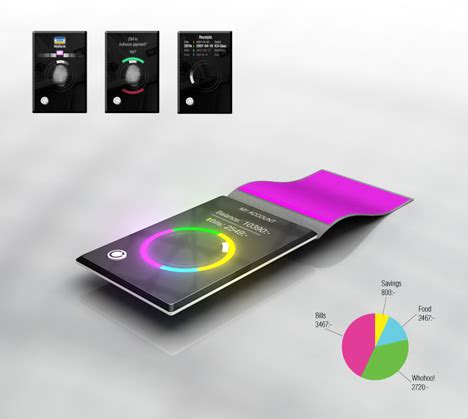

Biometric Security: The Future of Credit Card Verification

Another significant development in the world of credit cards is the introduction of biometric security features. These features, such as fingerprint or facial recognition, provide an additional layer of security, making it even more difficult for unauthorized individuals to access a user's account. This technology has been made possible by advancements in machine learning and artificial intelligence, which enable the accurate recognition of unique biometric characteristics.

How Biometric Security Works

Biometric security works by using unique physical or behavioral characteristics, such as fingerprints or facial features, to verify a user's identity. This information is then compared to a stored template, which is used to authenticate the user. If the biometric data matches the stored template, the user is granted access to their account. This process is secure, convenient, and eliminates the need for PINs or passwords.

Tokenization: Protecting Sensitive Information

Tokenization is another technology that has been introduced to enhance the security of credit cards. This process involves replacing sensitive information, such as credit card numbers, with unique tokens or digital identifiers. These tokens can be used to make transactions, but they do not contain any sensitive information, making them useless to hackers.

Benefits of Tokenization

Tokenization provides a number of benefits, including enhanced security, increased flexibility, and reduced liability. By replacing sensitive information with tokens, merchants and financial institutions can reduce their risk of data breaches and associated fines. Additionally, tokenization enables the secure storage and processing of sensitive information, making it easier to manage and protect.

Mobile Payments: The Rise of Contactless Transactions

Mobile payments have become increasingly popular in recent years, with many consumers using their smartphones to make contactless transactions. This technology has been made possible by the introduction of mobile payment apps, such as Apple Pay, Google Pay, and Samsung Pay, which enable users to store their credit card information securely on their device.

How Mobile Payments Work

Mobile payments work by using a combination of NFC and tokenization to enable secure and seamless transactions. When a user makes a transaction, their device communicates with the payment terminal using NFC, and the tokenized credit card information is used to authenticate the transaction.

Cryptocurrencies: The Future of Digital Payments

Cryptocurrencies, such as Bitcoin and Ethereum, have been gaining popularity in recent years, with many merchants and financial institutions beginning to accept them as a form of payment. These digital currencies use cryptography and decentralized networks to enable secure and transparent transactions.

Benefits of Cryptocurrencies

Cryptocurrencies provide a number of benefits, including increased security, reduced transaction fees, and greater flexibility. Additionally, cryptocurrencies enable fast and global transactions, making them an attractive option for cross-border payments.

Gallery of Modern Credit Card Technology

Frequently Asked Questions

What is contactless payment technology?

+Contactless payment technology is a type of payment technology that enables users to make transactions without the need for physical contact between the card and the payment terminal.

How does tokenization work?

+Tokenization works by replacing sensitive information, such as credit card numbers, with unique tokens or digital identifiers. These tokens can be used to make transactions, but they do not contain any sensitive information.

What is the benefit of using biometric security?

+The benefit of using biometric security is that it provides an additional layer of security, making it more difficult for unauthorized individuals to access a user's account.

In conclusion, the world of credit cards has undergone a significant transformation in recent years, with the integration of modern technology being a key driver of this change. From contactless payments to biometric security, tokenization to cryptocurrencies, the options for secure and convenient transactions are vast and varied. As technology continues to evolve, we can expect to see even more innovative features and functionality being introduced to the world of credit cards.