Homeownership is a dream shared by many, and navigating the mortgage approval process can be a daunting task, especially for first-time homebuyers. Total Credit Union (TCU) mortgage approval is no exception, requiring careful planning, attention to detail, and a thorough understanding of the process. In this article, we will delve into the intricacies of TCU mortgage approval, providing you with valuable insights and practical tips to increase your chances of a successful application.

Understanding TCU Mortgage Approval

TCU mortgage approval is a multi-step process that involves evaluating your creditworthiness, income, and financial situation to determine your eligibility for a mortgage loan. The goal of the lender is to assess the level of risk associated with lending you money and to ensure that you have the ability to repay the loan.

Tip 1: Check Your Credit Score

Your credit score plays a crucial role in determining your eligibility for a TCU mortgage loan. A good credit score can help you qualify for better interest rates and terms, while a poor credit score can lead to higher interest rates or even loan rejection. To improve your chances of approval, it's essential to check your credit score and report before applying for a mortgage.

You can request a free credit report from the three major credit reporting agencies: Equifax, Experian, and TransUnion. Review your report carefully, and dispute any errors or inaccuracies that may be affecting your credit score. Aim for a credit score of 700 or higher to increase your chances of approval.

Tip 2: Gather Required Documents

To apply for a TCU mortgage loan, you'll need to provide a range of documents, including:

- Proof of income (pay stubs, W-2 forms, tax returns)

- Proof of employment (letter from employer, business license)

- Proof of assets (bank statements, investment accounts)

- Proof of identity (driver's license, passport)

- Proof of creditworthiness (credit report, credit score)

Make sure you have all the necessary documents ready and in order before submitting your application. This will help you avoid delays and ensure a smooth application process.

Tip 3: Calculate Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a critical factor in determining your eligibility for a TCU mortgage loan. Your DTI ratio is calculated by dividing your total monthly debt payments by your gross income. To increase your chances of approval, aim for a DTI ratio of 36% or less.

To calculate your DTI ratio, add up your total monthly debt payments, including:

- Minimum credit card payments

- Car loan payments

- Student loan payments

- Alimony or child support payments

Then, divide this total by your gross income. For example, if your total monthly debt payments are $2,000 and your gross income is $6,000, your DTI ratio would be 33%.

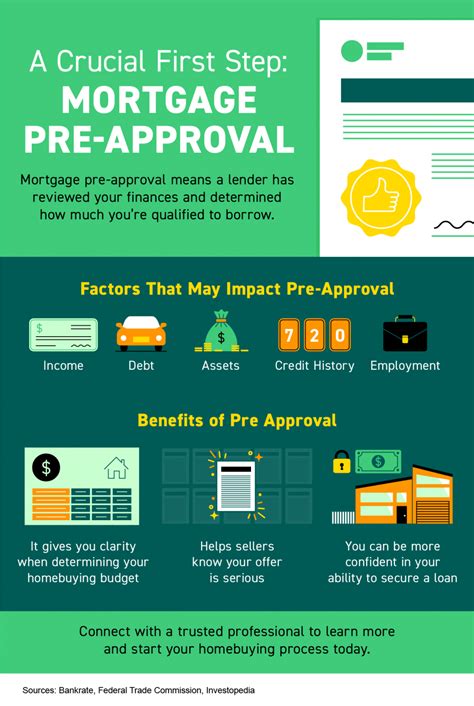

Tip 4: Consider a Pre-Approval

A pre-approval is a written statement from a lender indicating the amount of money they are willing to lend you. Getting pre-approved for a TCU mortgage loan can give you an edge in the homebuying process, as it shows sellers that you are a serious buyer.

To get pre-approved, you'll need to provide the same documents required for a mortgage application. The lender will review your creditworthiness and financial situation to determine the amount of money they are willing to lend you.

Tip 5: Work with a Mortgage Broker

A mortgage broker can help you navigate the complex mortgage application process and increase your chances of approval. A mortgage broker can:

- Help you choose the right mortgage product

- Assist with the application process

- Negotiate with lenders on your behalf

- Provide guidance on the homebuying process

When working with a mortgage broker, make sure to:

- Research their reputation and experience

- Check their licensing and credentials

- Ask about their fees and services

Gallery of TCU Mortgage Approval Tips

FAQ Section

What is the minimum credit score required for TCU mortgage approval?

+The minimum credit score required for TCU mortgage approval is 620.

How long does the TCU mortgage approval process take?

+The TCU mortgage approval process typically takes 30-60 days.

Can I get pre-approved for a TCU mortgage loan online?

+Yes, you can get pre-approved for a TCU mortgage loan online through the TCU website or through a mortgage broker.

By following these 5 tips for TCU mortgage approval, you can increase your chances of a successful application and achieve your dream of homeownership. Remember to check your credit score, gather required documents, calculate your DTI ratio, consider a pre-approval, and work with a mortgage broker to navigate the complex mortgage application process.