In today's fast-paced financial landscape, finding the right auto loan can be a daunting task. With numerous lenders and varying interest rates, it's essential to explore options that cater to your needs and budget. For individuals seeking a reliable and member-centric approach, a tech credit union auto loan might be the ideal solution. As a not-for-profit cooperative, credit unions focus on providing low rates and exceptional service to their members. In this article, we'll delve into the world of tech credit union auto loans, exploring their benefits, features, and how they can help you secure a low-rate loan.

What is a Tech Credit Union Auto Loan?

A tech credit union auto loan is a type of loan offered by credit unions that leverage technology to simplify the lending process. These loans are designed to provide members with competitive rates, flexible terms, and a more efficient application process. By utilizing online platforms, mobile apps, and other digital tools, tech credit unions can reduce costs and pass the savings on to their members.

Benefits of a Tech Credit Union Auto Loan

So, what sets tech credit union auto loans apart from traditional lenders? Here are some benefits that make them an attractive option for car buyers:

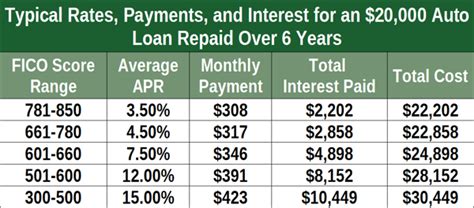

- Low Rates: Credit unions are not-for-profit cooperatives, which means they can offer lower interest rates compared to traditional banks and lenders.

- Flexible Terms: Tech credit unions often provide flexible repayment terms, allowing members to choose a loan duration that suits their financial situation.

- Streamlined Application Process: With online applications and digital documentation, the lending process is faster and more convenient.

- Personalized Service: As a member-centric organization, tech credit unions prioritize personalized service, ensuring that members receive tailored advice and support throughout the loan process.

How to Apply for a Tech Credit Union Auto Loan

Applying for a tech credit union auto loan is a straightforward process. Here's a step-by-step guide to help you get started:

- Check Eligibility: Research tech credit unions in your area and review their membership requirements. Some credit unions may require you to work for a specific employer, belong to a certain organization, or live in a particular area.

- Gather Documents: Typically, you'll need to provide identification, proof of income, and documentation for the vehicle you're purchasing.

- Choose a Loan Option: Select a loan term and interest rate that suits your financial situation. Tech credit unions often offer various loan options, including fixed-rate and variable-rate loans.

- Apply Online: Submit your application through the credit union's online platform or mobile app. You may need to create an account or log in to an existing one.

- Review and Approve: A representative from the tech credit union will review your application and contact you to discuss the details of your loan.

Tips for Getting Approved for a Tech Credit Union Auto Loan

To increase your chances of getting approved for a tech credit union auto loan, consider the following tips:

- Check Your Credit Score: A good credit score can help you qualify for lower interest rates and better loan terms.

- Provide Accurate Information: Ensure that your application and supporting documents are accurate and up-to-date.

- Choose a Realistic Loan Term: Select a loan term that aligns with your financial situation and budget.

- Consider a Co-Signer: If you have a limited credit history, consider adding a co-signer with a good credit score to your application.

Gallery of Tech Credit Union Auto Loan Benefits

Frequently Asked Questions

What is the difference between a tech credit union auto loan and a traditional auto loan?

+A tech credit union auto loan is offered by a not-for-profit cooperative that utilizes technology to streamline the lending process, providing lower interest rates and flexible terms.

How do I apply for a tech credit union auto loan?

+Apply online through the credit union's website or mobile app, providing required documentation and choosing a loan option that suits your financial situation.

What are the benefits of a tech credit union auto loan?

+Benefits include low interest rates, flexible repayment terms, a streamlined application process, and personalized service.

We hope this comprehensive guide has provided you with a deeper understanding of tech credit union auto loans and how they can help you secure a low-rate loan. By exploring the benefits, features, and application process, you'll be better equipped to make an informed decision about your auto financing needs. Remember to research and compare rates, terms, and benefits to find the best fit for your financial situation.