As the world becomes increasingly digital, technology credit unions have emerged as a vital financial option for individuals seeking affordable and flexible loan rates. Unlike traditional banks, tech credit unions leverage cutting-edge technology to provide fast, secure, and member-centric services. In this article, we will delve into the world of tech credit unions, exploring the benefits, features, and top loan rates available in the market.

What are Tech Credit Unions?

Tech credit unions are not-for-profit financial cooperatives that serve the financial needs of their members. They use technology to streamline processes, reduce costs, and offer competitive loan rates and terms. By leveraging digital platforms, tech credit unions can reach a wider audience, providing financial services to underserved communities and individuals.

Benefits of Tech Credit Unions

Before diving into the top loan rates, let's explore the benefits of tech credit unions:

- Lower Interest Rates: Tech credit unions offer competitive loan rates, often lower than those of traditional banks.

- Faster Application Process: Digital platforms enable quick and easy application processes, reducing the time it takes to receive loan approval.

- Increased Accessibility: Tech credit unions can reach a wider audience, providing financial services to individuals who may not have access to traditional banking services.

- Improved Security: Advanced technology ensures secure transactions and protects member data.

Top 5 Tech Credit Union Loan Rates

After researching various tech credit unions, we have compiled a list of the top 5 loan rates available in the market. Please note that rates are subject to change and may vary based on individual circumstances.

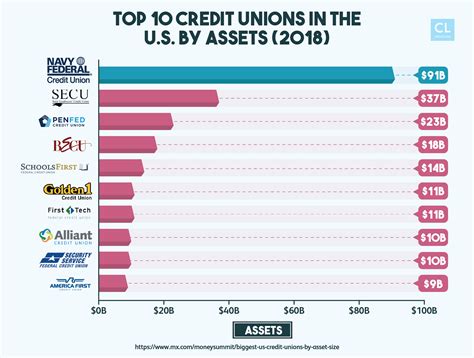

- Alliant Credit Union: 6.49% - 14.99% APR Alliant Credit Union offers personal loans with flexible repayment terms and competitive interest rates. With a digital platform, members can apply for loans, manage accounts, and access financial tools online.

- Navy Federal Credit Union: 6.95% - 17.99% APR Navy Federal Credit Union offers personal loans with competitive interest rates and flexible repayment terms. With a digital platform, members can apply for loans, manage accounts, and access financial tools online.

- PenFed Credit Union: 6.74% - 17.99% APR PenFed Credit Union offers personal loans with competitive interest rates and flexible repayment terms. With a digital platform, members can apply for loans, manage accounts, and access financial tools online.

- LightStream: 4.99% - 14.49% APR LightStream offers personal loans with competitive interest rates and flexible repayment terms. With a digital platform, members can apply for loans, manage accounts, and access financial tools online.

- LendingPoint: 9.99% - 35.99% APR LendingPoint offers personal loans with competitive interest rates and flexible repayment terms. With a digital platform, members can apply for loans, manage accounts, and access financial tools online.

How to Choose the Best Tech Credit Union Loan Rate

When selecting a tech credit union loan rate, consider the following factors:

- Interest Rate: Look for competitive interest rates that align with your financial goals.

- Repayment Terms: Choose a loan with flexible repayment terms that fit your budget.

- Fees: Check for any origination fees, late payment fees, or prepayment penalties.

- Credit Score: Consider the credit score requirements and how they may impact your loan application.

- Customer Service: Evaluate the tech credit union's customer service, including online support, phone support, and branch locations.

Gallery of Tech Credit Union Loan Rates

Frequently Asked Questions

What is a tech credit union?

+A tech credit union is a not-for-profit financial cooperative that uses technology to provide fast, secure, and member-centric services.

How do I choose the best tech credit union loan rate?

+Consider factors such as interest rate, repayment terms, fees, credit score requirements, and customer service when selecting a tech credit union loan rate.

Are tech credit unions secure?

+Yes, tech credit unions use advanced technology to ensure secure transactions and protect member data.

In conclusion, tech credit unions offer competitive loan rates and flexible repayment terms, making them an attractive option for individuals seeking affordable financial solutions. By considering factors such as interest rate, repayment terms, and customer service, you can choose the best tech credit union loan rate for your financial needs.