With the rising costs of owning a vehicle, it's essential to find the best car loan rates to suit your budget. Tech Credit Union, a member-owned financial cooperative, offers competitive car loan rates to its members. In this article, we'll delve into the world of Tech Credit Union car loan rates, exploring the benefits, features, and requirements to help you make informed decisions when financing your next vehicle.

Understanding Tech Credit Union Car Loan Rates

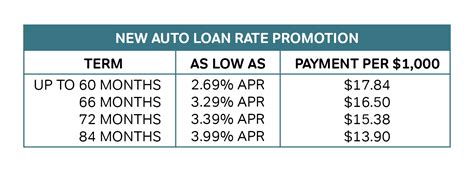

Tech Credit Union car loan rates are influenced by various factors, including your credit score, loan term, and the type of vehicle you're purchasing. As a credit union, Tech CU offers more favorable rates compared to traditional banks, making it an attractive option for those seeking affordable car financing.

Factors Affecting Tech Credit Union Car Loan Rates

Several factors contribute to the determination of Tech Credit Union car loan rates. These include:

- Credit Score: Your credit score plays a significant role in determining the interest rate you'll qualify for. A good credit score can lead to lower interest rates, while a poor credit score may result in higher rates.

- Loan Term: The length of your loan can impact your interest rate. Shorter loan terms often come with lower interest rates, while longer loan terms may have higher rates.

- Vehicle Type: The type of vehicle you're purchasing can also influence your interest rate. Newer vehicles or those with lower mileage may qualify for lower rates, while older vehicles or those with higher mileage may have higher rates.

- Loan Amount: The amount you borrow can also affect your interest rate. Larger loan amounts may come with higher interest rates, while smaller loan amounts may have lower rates.

Benefits of Tech Credit Union Car Loan Rates

Tech Credit Union car loan rates offer several benefits to its members. These include:

- Competitive Rates: Tech CU offers competitive car loan rates, making it an attractive option for those seeking affordable car financing.

- Flexible Loan Terms: Tech CU offers flexible loan terms, allowing you to choose a loan term that suits your budget and financial goals.

- No Prepayment Penalties: Tech CU does not charge prepayment penalties, giving you the freedom to pay off your loan early without incurring additional fees.

- Low Fees: Tech CU charges low fees, reducing the overall cost of your loan.

How to Qualify for the Best Tech Credit Union Car Loan Rates

To qualify for the best Tech Credit Union car loan rates, follow these tips:

- Maintain a Good Credit Score: A good credit score can lead to lower interest rates, so make sure to maintain a good credit score by making timely payments and keeping credit utilization low.

- Choose a Shorter Loan Term: Shorter loan terms often come with lower interest rates, so consider choosing a shorter loan term to reduce your interest rate.

- Borrow a Smaller Amount: Borrowing a smaller amount can lead to lower interest rates, so consider borrowing only what you need.

- Consider a Newer Vehicle: Newer vehicles or those with lower mileage may qualify for lower rates, so consider purchasing a newer vehicle.

Tech Credit Union Car Loan Rates vs. Traditional Banks

Tech Credit Union car loan rates are often more favorable compared to traditional banks. Here's a comparison of Tech CU car loan rates with those of traditional banks:

- Lower Interest Rates: Tech CU offers lower interest rates compared to traditional banks, making it a more affordable option for car financing.

- Lower Fees: Tech CU charges lower fees compared to traditional banks, reducing the overall cost of your loan.

- More Flexible Loan Terms: Tech CU offers more flexible loan terms compared to traditional banks, giving you more options to choose from.

How to Apply for a Tech Credit Union Car Loan

Applying for a Tech Credit Union car loan is a straightforward process. Here's a step-by-step guide:

- Check Your Eligibility: Check your eligibility for a Tech CU car loan by visiting their website or contacting their customer service.

- Gather Required Documents: Gather the required documents, including your identification, income proof, and credit report.

- Submit Your Application: Submit your application online or in-person at a Tech CU branch.

- Review and Approve Your Application: Tech CU will review and approve your application, and you'll receive a decision on your loan application.

Conclusion

Tech Credit Union car loan rates offer several benefits, including competitive rates, flexible loan terms, and low fees. By understanding the factors that affect Tech CU car loan rates and following the tips outlined in this article, you can qualify for the best rates and make your car financing more affordable. Remember to always compare rates and terms with traditional banks to ensure you're getting the best deal.

What are the current car loan rates offered by Tech Credit Union?

+Tech Credit Union car loan rates vary depending on the loan term, credit score, and vehicle type. Please visit their website or contact their customer service for the most up-to-date rates.

How do I qualify for the best Tech Credit Union car loan rates?

+To qualify for the best Tech Credit Union car loan rates, maintain a good credit score, choose a shorter loan term, borrow a smaller amount, and consider purchasing a newer vehicle.