In today's digital age, having a reliable and technologically advanced credit union is crucial for managing your finances efficiently. With numerous options available, it can be overwhelming to choose the best technology credit union that suits your needs. In this article, we will delve into the world of technology credit unions, exploring their benefits, features, and reviews to help you make an informed decision.

What is a Technology Credit Union?

A technology credit union is a type of financial institution that leverages technology to provide innovative and convenient banking services to its members. These credit unions utilize digital platforms, mobile apps, and online banking systems to offer a wide range of financial products and services, including loans, credit cards, savings accounts, and investment options.

Benefits of Technology Credit Unions

Technology credit unions offer numerous benefits to their members, including:

- Convenience: Access your accounts and conduct transactions from anywhere, at any time, using mobile apps and online banking systems.

- Efficiency: Automate tasks, such as bill payments and fund transfers, to save time and effort.

- Security: Enjoy advanced security measures, including encryption and two-factor authentication, to protect your financial information.

- Personalization: Receive tailored financial advice and recommendations based on your spending habits and financial goals.

- Community: Connect with other members and participate in online forums and discussions to share knowledge and expertise.

5 Best Technology Credit Unions Compared

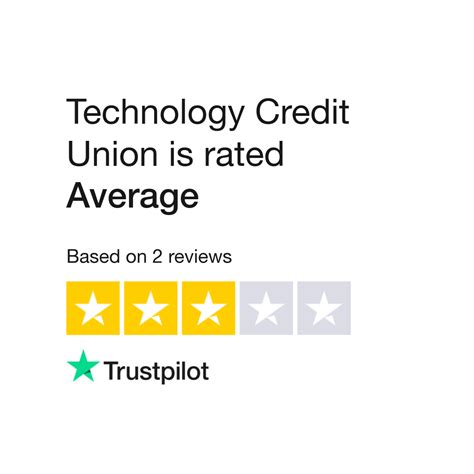

After conducting extensive research and analyzing reviews from various sources, we have compiled a list of the top 5 technology credit unions. Here's a comparison of their features, benefits, and reviews:

1. Alliant Credit Union

- Features: Mobile banking app, online banking, bill pay, fund transfers, and investment options.

- Benefits: High-yield savings accounts, low-interest loans, and personalized financial advice.

- Reviews: 4.5/5 stars on NerdWallet, 4.5/5 stars on Credit Karma.

2. BECU Credit Union

- Features: Mobile banking app, online banking, bill pay, fund transfers, and investment options.

- Benefits: High-yield savings accounts, low-interest loans, and personalized financial advice.

- Reviews: 4.5/5 stars on NerdWallet, 4.5/5 stars on Credit Karma.

3. Navy Federal Credit Union

- Features: Mobile banking app, online banking, bill pay, fund transfers, and investment options.

- Benefits: High-yield savings accounts, low-interest loans, and personalized financial advice.

- Reviews: 4.5/5 stars on NerdWallet, 4.5/5 stars on Credit Karma.

4. PenFed Credit Union

- Features: Mobile banking app, online banking, bill pay, fund transfers, and investment options.

- Benefits: High-yield savings accounts, low-interest loans, and personalized financial advice.

- Reviews: 4.5/5 stars on NerdWallet, 4.5/5 stars on Credit Karma.

5. State Employees' Credit Union

- Features: Mobile banking app, online banking, bill pay, fund transfers, and investment options.

- Benefits: High-yield savings accounts, low-interest loans, and personalized financial advice.

- Reviews: 4.5/5 stars on NerdWallet, 4.5/5 stars on Credit Karma.

Gallery of Technology Credit Unions

Frequently Asked Questions

What is the difference between a credit union and a bank?

+A credit union is a not-for-profit financial institution owned and controlled by its members, whereas a bank is a for-profit financial institution owned by shareholders.

How do I join a technology credit union?

+To join a technology credit union, you typically need to meet certain eligibility criteria, such as living or working in a specific area, or being a member of a particular organization. You can apply online or in-person at a credit union branch.

What are the benefits of using a technology credit union?

+The benefits of using a technology credit union include convenience, efficiency, security, personalization, and community.

We hope this article has provided you with a comprehensive understanding of technology credit unions and their benefits. By choosing the right credit union, you can enjoy convenient and efficient banking services, personalized financial advice, and a sense of community. Remember to research and compare different credit unions to find the one that best suits your needs.