In today's economy, finding the right credit union to manage your finances is crucial. Valley Strong Credit Union, a reputable financial institution, offers competitive CD rates to help you grow your savings. Here's an in-depth look at Valley Strong Credit Union's CD rates and what you need to know.

Why Choose Valley Strong Credit Union?

Before diving into the CD rates, it's essential to understand why Valley Strong Credit Union stands out from other financial institutions. As a not-for-profit cooperative, Valley Strong Credit Union is committed to serving its members' financial needs. With a strong focus on community involvement and exceptional customer service, this credit union has earned the trust of its members.

What are CD Rates?

CD rates, also known as Certificate of Deposit rates, refer to the interest rates offered by credit unions and banks on time deposits. These rates are typically higher than those offered on traditional savings accounts, making them an attractive option for individuals looking to save for the future.

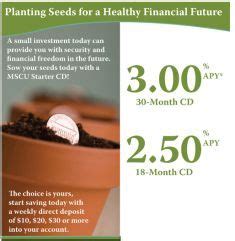

Valley Strong Credit Union CD Rates

Valley Strong Credit Union offers a range of CD rates to suit different financial goals and timeframes. Here are some of the current CD rates available:

CD Rate Tiers

Valley Strong Credit Union's CD rates are divided into several tiers, each with its own set of interest rates and term lengths. Here's a breakdown of the current CD rate tiers:

- Short-Term CDs: These CDs have terms ranging from 3 months to 1 year, with interest rates starting at 1.50% APY.

- Medium-Term CDs: These CDs have terms ranging from 1 year to 3 years, with interest rates starting at 2.00% APY.

- Long-Term CDs: These CDs have terms ranging from 3 years to 5 years, with interest rates starting at 2.50% APY.

CD Rate Comparison

To give you a better idea of how Valley Strong Credit Union's CD rates compare to other financial institutions, here's a comparison chart:

| Institution | 3-Month CD Rate | 1-Year CD Rate | 3-Year CD Rate | 5-Year CD Rate |

|---|---|---|---|---|

| Valley Strong Credit Union | 1.50% APY | 2.00% APY | 2.50% APY | 3.00% APY |

| Bank of America | 1.25% APY | 1.75% APY | 2.25% APY | 2.75% APY |

| Wells Fargo | 1.10% APY | 1.60% APY | 2.10% APY | 2.60% APY |

How to Open a CD Account

Opening a CD account with Valley Strong Credit Union is a straightforward process. Here are the steps to follow:

- Visit the Valley Strong Credit Union website: Go to the Valley Strong Credit Union website and click on the "Accounts" tab.

- Choose your CD term: Select the CD term that suits your financial goals, ranging from 3 months to 5 years.

- Fund your account: Fund your CD account with a minimum deposit of $1,000.

- Review and sign: Review the terms and conditions, then sign the account agreement.

Tips for Maximizing Your CD Returns

To get the most out of your CD investment, here are some tips to keep in mind:

- Choose a longer term: Longer-term CDs typically offer higher interest rates.

- Make a larger deposit: The more you deposit, the higher your interest earnings will be.

- Consider a jumbo CD: Jumbo CDs often require a higher minimum deposit but offer higher interest rates.

Gallery of CD Rates and Tips

Frequently Asked Questions

What is the minimum deposit required to open a CD account?

+The minimum deposit required to open a CD account with Valley Strong Credit Union is $1,000.

How long do I need to keep my money in a CD account?

+The term length of a CD account varies from 3 months to 5 years, depending on the type of CD you choose.

Can I withdraw my money from a CD account before the term ends?

+Yes, you can withdraw your money from a CD account before the term ends, but you may face early withdrawal penalties.

In conclusion, Valley Strong Credit Union's CD rates offer a competitive way to grow your savings. By understanding the different CD rate tiers, choosing the right term length, and following the tips outlined above, you can maximize your returns and achieve your financial goals.