In today's digital age, online banking has become an essential part of our financial lives. Tech credit unions, in particular, offer a range of online banking services that can help members manage their finances more efficiently. However, to get the most out of these services, it's essential to understand how to maximize their potential. In this article, we'll explore five ways to maximize tech credit union online banking, helping you to take control of your finances and make the most of your credit union membership.

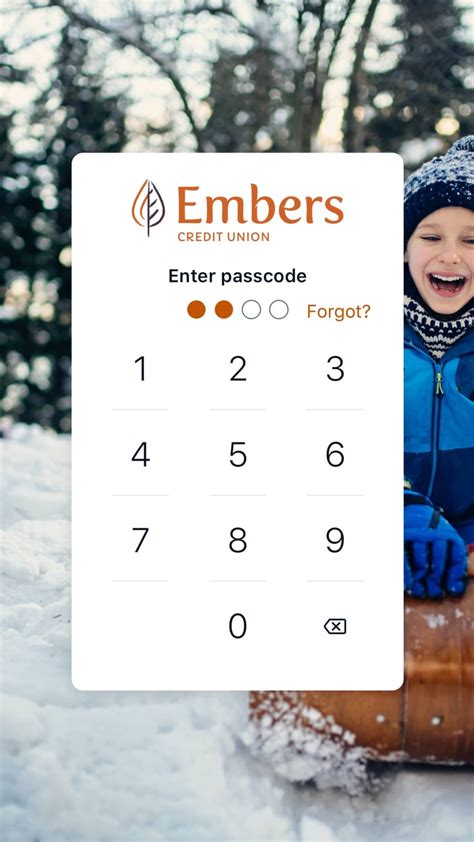

1. Take Advantage of Mobile Banking Apps

One of the most significant advantages of tech credit union online banking is the ability to access your accounts on-the-go using mobile banking apps. These apps allow you to check your account balances, transfer funds, pay bills, and even deposit checks remotely. To maximize the potential of mobile banking apps, make sure to:

- Download the app from the credit union's website or app store

- Enable biometric login (e.g., fingerprint or facial recognition) for added security

- Set up push notifications to stay informed about account activity

- Use the app to deposit checks and avoid visiting a branch

Benefits of Mobile Banking Apps

- Convenience: Access your accounts anywhere, anytime

- Speed: Deposit checks and transfer funds quickly and easily

- Security: Enable biometric login and two-factor authentication for added security

2. Set Up Account Alerts and Notifications

Account alerts and notifications are an essential feature of tech credit union online banking. These alerts can help you stay informed about account activity, detect potential fraud, and avoid overdrafts. To maximize the potential of account alerts and notifications:

- Log in to your online banking account and navigate to the alerts and notifications section

- Set up alerts for low account balances, large transactions, and suspicious activity

- Enable notifications for bill payments, loan payments, and credit card activity

- Customize your alert preferences to suit your needs

Benefits of Account Alerts and Notifications

- Security: Detect potential fraud and stay informed about account activity

- Convenience: Receive notifications about bill payments and loan payments

- Peace of mind: Stay informed about your account balances and avoid overdrafts

3. Use Online Bill Pay and Transfer Services

Online bill pay and transfer services are a convenient way to manage your finances using tech credit union online banking. These services allow you to pay bills, transfer funds, and even send money to friends and family. To maximize the potential of online bill pay and transfer services:

- Log in to your online banking account and navigate to the bill pay and transfer section

- Set up payees and schedule bill payments

- Use the transfer service to move funds between accounts

- Take advantage of person-to-person payment services

Benefits of Online Bill Pay and Transfer Services

- Convenience: Pay bills and transfer funds quickly and easily

- Speed: Schedule bill payments and transfers in advance

- Security: Use secure encryption to protect your transactions

4. Monitor Your Credit Report and Score

Monitoring your credit report and score is essential for maintaining good credit health. Tech credit unions often offer credit monitoring services as part of their online banking platform. To maximize the potential of credit monitoring:

- Log in to your online banking account and navigate to the credit monitoring section

- Check your credit report and score regularly

- Dispute any errors or inaccuracies on your report

- Use the credit monitoring service to track changes to your credit score

Benefits of Credit Monitoring

- Security: Detect potential identity theft and errors on your report

- Convenience: Access your credit report and score online

- Peace of mind: Stay informed about your credit health

5. Take Advantage of Financial Education and Resources

Tech credit unions often offer financial education and resources as part of their online banking platform. These resources can help you improve your financial literacy and make informed decisions about your money. To maximize the potential of financial education and resources:

- Log in to your online banking account and navigate to the financial education section

- Take advantage of online courses, webinars, and tutorials

- Use financial calculators and tools to plan and budget

- Access financial news and articles to stay informed

Benefits of Financial Education and Resources

- Knowledge: Improve your financial literacy and make informed decisions

- Convenience: Access financial education and resources online

- Peace of mind: Stay informed about personal finance and money management

By following these five tips, you can maximize the potential of tech credit union online banking and take control of your finances. Remember to take advantage of mobile banking apps, set up account alerts and notifications, use online bill pay and transfer services, monitor your credit report and score, and take advantage of financial education and resources. With these tips, you'll be well on your way to becoming a savvy online banking user.

What is tech credit union online banking?

+Tech credit union online banking is a digital platform that allows credit union members to manage their accounts, pay bills, transfer funds, and access financial education and resources online.

How do I access tech credit union online banking?

+To access tech credit union online banking, log in to your credit union's website or mobile app using your username and password.

Is tech credit union online banking secure?

+Yes, tech credit union online banking is secure. Credit unions use encryption, firewalls, and other security measures to protect member data and prevent unauthorized access.