The technology sector has long been a magnet for private equity firms, attracted by the potential for high returns and the ever-evolving landscape of innovative companies. In recent years, the tech industry has continued to boom, with private equity firms investing heavily in software, cybersecurity, data analytics, and other areas. Here, we'll highlight some of the top tech private equity firms to watch, exploring their investment strategies, notable deals, and the trends that are shaping their approaches.

Private equity firms are drawn to the tech sector for several reasons. For one, technology companies often have high growth potential, driven by the constant demand for new and improved products and services. Additionally, the tech industry is characterized by low capital expenditure requirements, which can make it more attractive to private equity investors seeking to generate returns through operational improvements and strategic acquisitions.

The tech private equity landscape is highly competitive, with numerous firms vying for a piece of the action. That being said, some firms have established themselves as leaders in the space, with a proven track record of successful investments and exits.

Top Tech Private Equity Firms

1. KKR

KKR is one of the largest and most well-known private equity firms globally, with a significant presence in the tech sector. The firm's tech investments are focused on areas such as software, cybersecurity, and data analytics. Notable deals include the acquisition of cybersecurity firm Optiv Security and the investment in software company Ensono.

2. Thoma Bravo

Thoma Bravo is a leading private equity firm specializing in software and technology investments. The firm has a long history of successful investments in the sector, including the acquisition of cybersecurity firm Barracuda Networks and the investment in software company McAfee.

3. Vista Equity Partners

Vista Equity Partners is a private equity firm focused exclusively on investing in software and technology-enabled businesses. The firm has a strong track record of successful investments, including the acquisition of software company Apptio and the investment in data analytics firm Marketo.

4. Silver Lake

Silver Lake is a private equity firm that invests in technology and technology-enabled businesses. The firm has a strong focus on areas such as software, cybersecurity, and data analytics. Notable deals include the acquisition of software company Serena Software and the investment in cybersecurity firm Symantec.

5. Blackstone

Blackstone is one of the largest private equity firms globally, with a significant presence in the tech sector. The firm's tech investments are focused on areas such as software, cybersecurity, and data analytics. Notable deals include the acquisition of software company Thomson Reuters Financial & Risk and the investment in cybersecurity firm iSIGHT Partners.

Trends Shaping Tech Private Equity

Several trends are shaping the tech private equity landscape, from the increasing focus on software and cybersecurity to the growing importance of data analytics and artificial intelligence.

1. Software and Cybersecurity

Software and cybersecurity are two of the most attractive areas for tech private equity firms, driven by the high growth potential and the constant demand for new and improved products and services.

2. Data Analytics and Artificial Intelligence

Data analytics and artificial intelligence are becoming increasingly important areas of focus for tech private equity firms, as companies seek to leverage data to drive business insights and decision-making.

3. Cloud Computing

Cloud computing is another trend shaping the tech private equity landscape, as companies seek to migrate their applications and data to the cloud to reduce costs and improve scalability.

4. Digital Transformation

Digital transformation is a key trend driving tech private equity investments, as companies seek to transform their businesses through the adoption of new technologies and innovative business models.

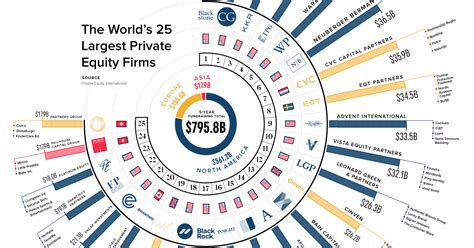

Gallery of Tech Private Equity Firms

Conclusion

The tech private equity landscape is highly competitive, with numerous firms vying for a piece of the action. However, some firms have established themselves as leaders in the space, with a proven track record of successful investments and exits. As the tech industry continues to evolve, we can expect to see these firms remain at the forefront of the market, driving innovation and growth through their investments.

We invite you to share your thoughts on the top tech private equity firms to watch. Which firms do you think are leading the pack, and what trends do you see shaping the tech private equity landscape? Share your comments below.

What is private equity?

+Private equity is a type of investment where a firm or individual provides capital to a private company, with the goal of eventually taking the company public or selling it for a profit.

What is tech private equity?

+Tech private equity refers to private equity investments in technology companies, including software, cybersecurity, data analytics, and other areas.

What are the benefits of tech private equity investments?

+Tech private equity investments can provide high returns, driven by the high growth potential of technology companies. Additionally, private equity firms can bring operational expertise and strategic guidance to portfolio companies.